Get Carbon Credit Exchanges

When you want to invest in carbon credits, you need to understand how they work. Carbon credit exchanges allow businesses, governments, and individuals to trade the emissions that cause greenhouse gases. This allows organizations to meet emission reduction goals without reducing their production. These systems also reduce economic inequality and improve water quality. The carbon market has become very popular, especially among consumers.

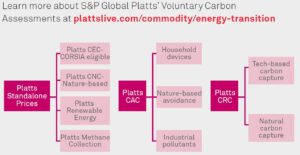

carbon credit exchange can be broken into two main categories: voluntary and compliance. Compliance carbon markets must follow specific rules and regulations. If an organization does not adhere to these rules, it cannot sell its credits. However, if the organization meets the criteria, it can continue to sell its allowances.

For example, if a factory produces 100,000 tonnes of greenhouse gas emissions annually, the company must buy a certain number of carbon credits to meet its emissions cap. It can purchase the credits from a manufacturer, but it can also opt to use the funds to buy new machinery or other assets.

How Do I Get Carbon Credit Exchanges?

The price of carbon is determined by several factors. These include the volume of credits traded, the nature of the underlying project, and the geography of the project. Generally, industrial projects have higher GHG offset potential than community-based projects. As the global population increases, energy use is expected to increase. In these cases, the price of carbon will increase.

One of the primary objectives of the carbon market is to reduce the overall quantity of carbon. While the prices of carbon credits vary, they generally fall between $40 and $80 per metric ton of carbon dioxide. They can be purchased from businesses, individual stocks, Exchange-Traded Funds (ETFs), and futures.

Carbon Credit ETFs are the easiest way to invest in the carbon market. To buy them, you need to open a brokerage account with a broker. Brokers usually receive commission for their services. Some brokers offer PDF sheets that explain investments in detail. You can also log into your existing brokerage account. Alternatively, there are popular investment apps that can be used to trade carbon ETFs.

An example of a carbon credit is a reforestation project. During the construction of a reforestation site, carbon dioxide is removed from the air. Often, this project is managed by a local group. Many such projects contribute to the United Nations Sustainable Development Goals. Since these projects have additional environmental and social benefits, the carbon credits from them have more value to buyers.

There are many carbon credit exchanges in operation around the world. Each market is different, however. For example, the AirCarbon Exchange tokenized its carbon credit exchange in 2017. Unlike traditional carbon exchanges, AirCarbon exchange allows end users to purchase carbon credits easily.

Another carbon exchange is the Emissions Trading System. Introduced in 2005, the ETS has grown into one of the largest carbon markets in the world. The system allows participants to buy or sell their allowances, and the European Commission validates the ownership transfers within the EU.